does massachusetts have an estate or inheritance tax

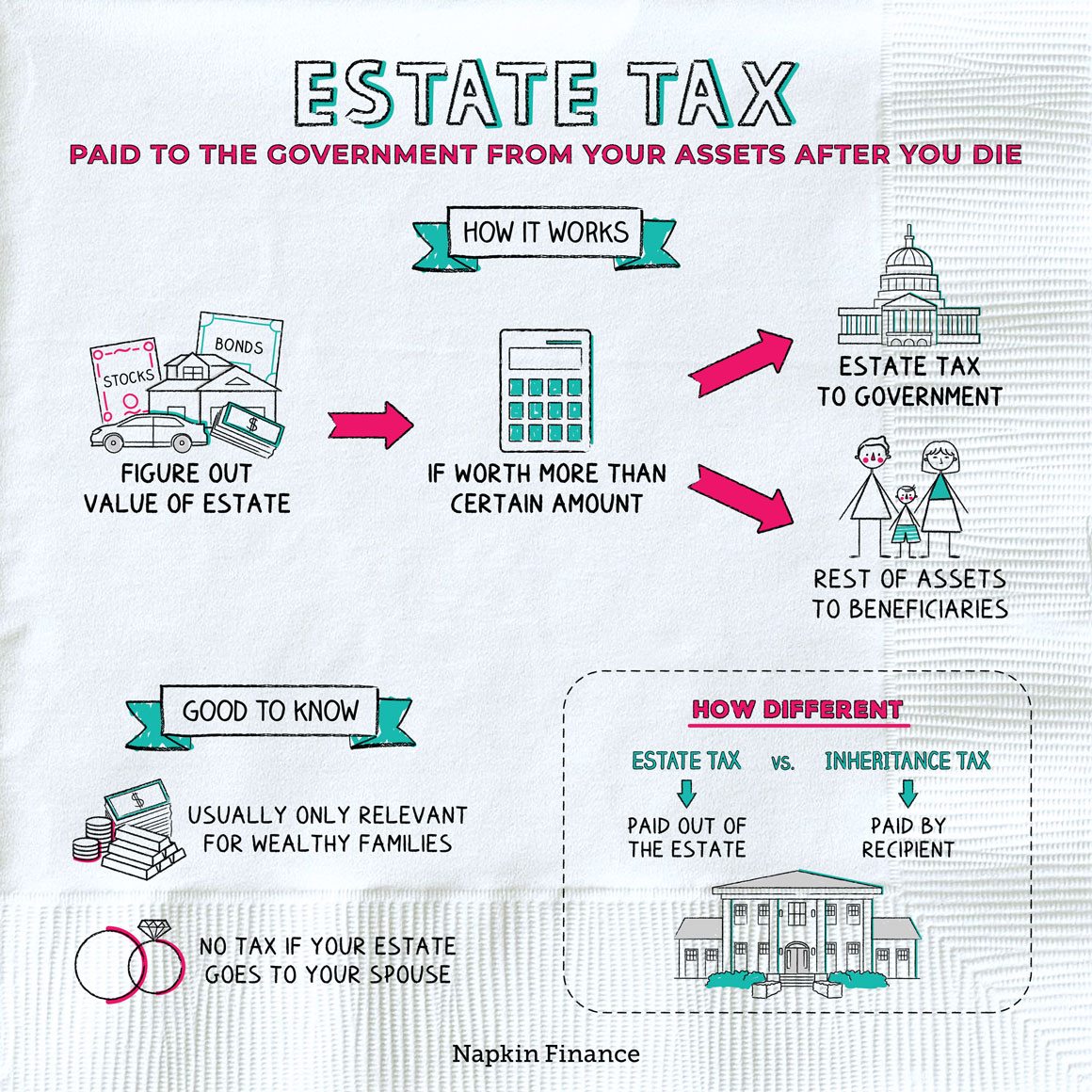

Legacy and Succession Tax. Interestingly at least to those who work in this field unlike the federal estate tax which only taxes the amount over the threshold for taxation if a Massachusetts estate exceeds the 1 million threshold all of it is taxed though at much lower rates than the federal estate tax.

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

Massachusetts doesnt have an inheritance tax.

. Inheritance tax is based on the laws of the state where the person leaving the inheritance resides at the time of their death. Since there is no federal inheritance tax in the United States this tax is. Massachusetts has an estate tax but not an inheritance tax.

But if you inherit money or assets from someone who lived in another state make sure you verify state law. Here are a few. The Massachusetts taxable estate is 940000 990000 less 50000.

This means that if you inherit money or assets from someone who lived in Massachusetts at the time of their death you will not have to pay taxes on those amounts. Massachusetts does not have inheritance tax. Computation of the credit for state death taxes for Massachusetts estate tax purposes.

Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut. Massachusetts has no inheritance tax. Massachusetts and Oregon have the lowest exemption levels at 1 million with Connecticut having the highest exemption level.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20. Some states will levy an inheritance tax regardless of where the beneficiary or heir lives. It is still important for you to understand how inheritance tax works however because it still could affect you.

M-F 800 AM to 430 PM. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. The Legacy and Succession Tax RSA 86 was repealed effective for deaths occurring on or after January 1 2003.

Massachusetts residents face a multitude of taxes. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. It also does not have a gift tax. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Fortunately Massachusetts does not levy an inheritance tax. The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20. While many people confuse inheritance taxes and estate taxes theyre actually two slightly different things. If the estate is worth less than 1000000 you dont need to file a return or.

Fortunately Massachusetts does not levy an inheritance tax. Therefore this tax would not apply. Call 603 230-5920 M-F 800 AM to 430 PM.

If you are a resident of Massachusetts and you die with more than 1 million in your taxable estate then you owe a Massachusetts estate tax. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000. An inheritance tax is a tax that beneficiaries who receive an inheritance have to pay based on how large that inheritance is.

An estate tax is not the same as an inheritance tax. Massachusetts and Oregon have the lowest exemption levels at 1 million with Connecticut having the highest exemption level.

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Tax Foundation Most States Moving Away From Estate Inheritance Taxes Wa Has Nation S Highest Estate Tax Rate Opportunity Washington

What Is An Estate Tax Napkin Finance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Inheritance And Gift Taxes In Connecticut And Other States

How Much Is Inheritance Tax Community Tax

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Four Reasons We Need Strong Estate Taxes Mass Budget And Policy Center

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die